Frictionless Onboarding. Streamlined Compliance.

Automate ID verification with aIDentix and reduce manual work while ensuring KYC compliance.

8+ customers are satisfied with our service

01 Benefits

Elevating experiences and driving success through our service

Where we offer transformative solutions tailored to drive your success. Let's elevate your experiences and achieve extraordinary results together.

Unmatched Security

Utilize industry-leading technologies like Liveness Detection.

Benefit from Database Checks and Behavioral Anti-Fraud for comprehensive protection.

Maintain compliance with KYC regulations.

Benefit from Database Checks and Behavioral Anti-Fraud for comprehensive protection.

Maintain compliance with KYC regulations.

Effortless User Experience

Minimise drop-offs with our user-friendly flow

Auto-capture IDs for fast and accurate verification.

Client customisation for a seamless brand experience.

Auto-capture IDs for fast and accurate verification.

Client customisation for a seamless brand experience.

Enhanced Efficiency

Streamline workflows with a user-friendly dashboard.

Manage cases and customise verification processes.

Plug&Play - No coding required for easy setup and management.

Manage cases and customise verification processes.

Plug&Play - No coding required for easy setup and management.

Reach and Accuracy

Software development involves the design, creation, and maintenance of software solutions.

These solutions are tailored to address specific organizational needs.

They help improve processes and provide ongoing support.

These solutions are tailored to address specific organizational needs.

They help improve processes and provide ongoing support.

200,000+

KYC Answers

8

Happy Customers

1,000,000+

Processed Documents

02 How we help

Digital Identity You Can Trust

aIDentix makes digital identity simple and secure. Our platform combines liveness verification, advanced document checks, and external database validation to deliver reliable results in seconds. Designed for seamless integration, aIDentix helps businesses verify customers quickly, prevent fraud, and build digital trust—without adding complexity.

03 How it works

Empowering Excellence: Unveiling Our Trailblazing Software Solutions

01

Document Verification.

The user scans their ID, and the system extracts the key information to check for accuracy and validity.

01

Document Verification.

The user scans their ID, and the system extracts the key information to check for accuracy and validity.

02

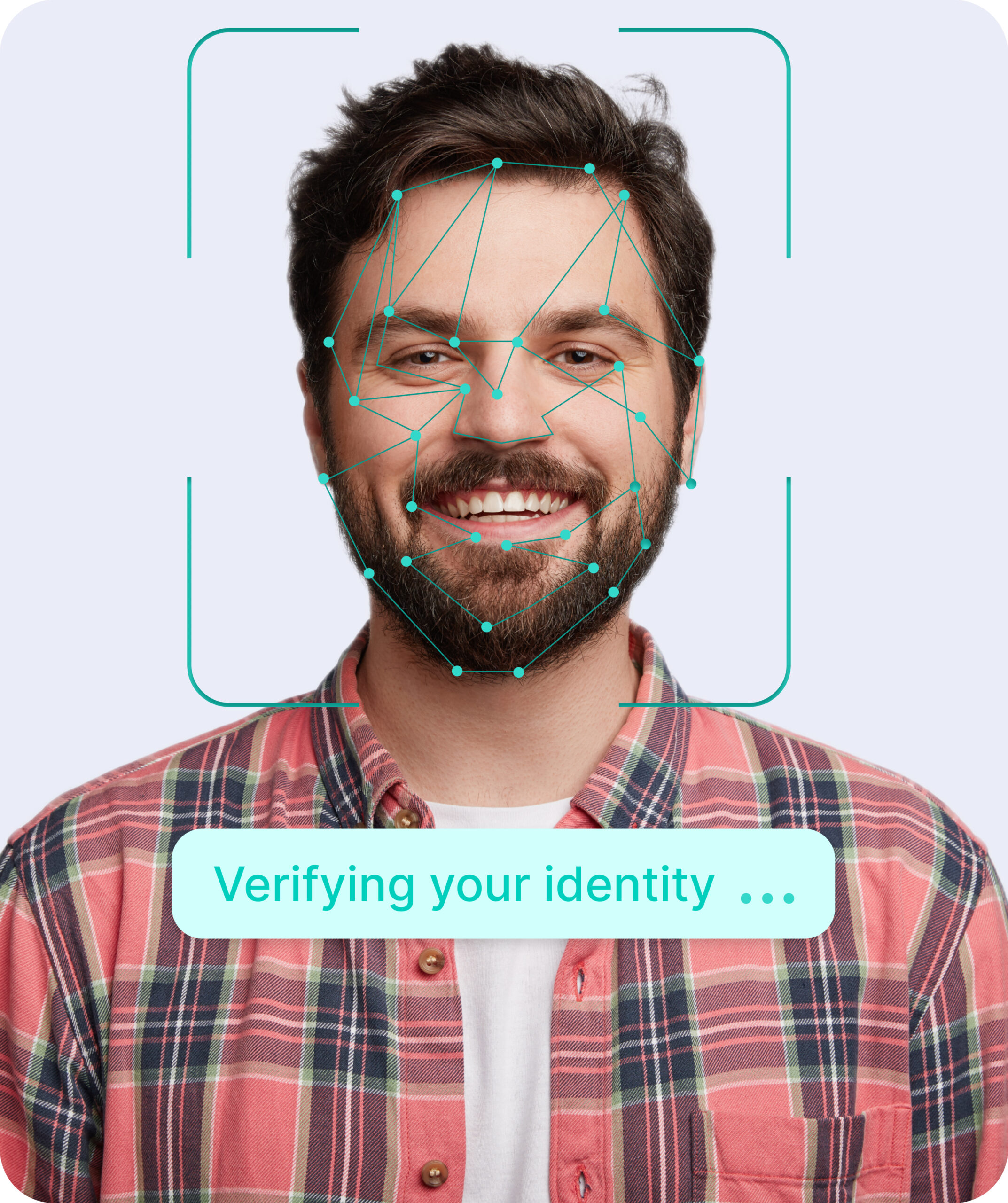

Video Verification

The user records a short video following simple on-screen instructions. This step helps confirm their presence and detect any spoofing attempts.

02

Video Verification.

The user records a short video following simple on-screen instructions. This step helps confirm their presence and detect any spoofing attempts.

03

Data Processing.

The system compares the information from the ID and video to ensure everything matches. Based on the results, it confirms the user’s identity or flags any issues for review.

03

Data processing.

The system compares the information from the ID and video to ensure everything matches. Based on the results, it confirms the user’s identity or flags any issues for review.

01

Document Verification.

The user scans their ID, and the system extracts the key information to check for accuracy and validity.

02

Video Verification.

The user records a short video following simple on-screen instructions. This step helps confirm their presence and detect any spoofing attempts.

03

Data processing.

The system compares the information from the ID and video to ensure everything matches. Based on the results, it confirms the user’s identity or flags any issues for review.

04 Feedback

Hear from our clients

Our partners' success speaks for itself — their glowing feedback is a reflection of the impact we strive to deliver every day.

Unicredit Bulbank partnered with DSS to implement an Optical Character Recognition solution that provides an automated KYC process for the bank's retail users. It is a plug-and-play system that does not require any development effort from our team. It takes a photo of an ID, crops the necessary format, and extracts the relevant information types (name, address, ID number), which is then returned in a machine-readable form. This seamless process is much faster and eliminates the possibility of human errors, resulting in a significantly improved customer experience. We highly recommend DSS's OCR product for easy document digitisation.

Anton Kutev

Strategic Initiatives Manager at Unicredit Bulbank

We recently integrated aIDentix into our mobile onboarding process. The app is extremely user-friendly, making it easy for our customers to complete their identity verification quickly and securely. It has significantly reduced onboarding time while ensuring we remain fully compliant with regulatory standards. The accuracy and reliability of digital identity verification and KYC's customisation capabilities allowed us to seamlessly tailor the process to meet our specific needs. aIDentix has not only improved our operational efficiency but also improved the overall customer experience. We highly recommend it for any financial institution looking to optimize their onboarding process.

Senior Manager

Digital Channels at local Bank

05 FAQs

Answers You Need: Frequently Asked Questions

Do you have any other questions?

What is digital identity verification?

Digital identity verification is the process

of confirming a person’s identity using digital methods, such as scanning

documents, checking liveness and physical presence via video, and responding

to validation instructions. It helps reduce fraud, ensure compliance, and

significantly speeds up the verification process by eliminating the need for users

to visit a physical office.

Is your solution compliant with data privacy regulations?

Yes. aIDentix is

designed to be compliant with global data protection standards, including GDPR,

ISO 9001:2015, ISO/IEC 20000-1:2018, ISO/IEC 27001:2022, ISO/IEC

27701:2019 and other relevant regulations. All user data is encrypted and

securely stored.

Who can use this service?

aIDentix can be used by businesses across

industries—such as finance, insurance, healthcare, and e-commerce—that need

to onboard or verify users securely.

What types of documents can be verified?

aIDentix supports a wide range of

government-issued identity documents, including international passports, driver’s

licenses, and European Union national ID cards. Our product is designed with

scalability in mind, and we are actively working to expand support for additional

countries and document types based on our product roadmap and client

requirements.

06 Pricing Plan

Pricing That Makes Sense

ESSENTIAL

€0.30 /per verification

€99 Minimum monthly commitment.

To cover essential business needs like client’s identity verification.

Document Verification

Age Verification

1 KYC questionnaires

Email Verification

Multi-factor Authentication

1 Team Member (each additional 10€/month)

COMPLIANCE

Best Plan

€0.70 /per verification

€199 Minimum monthly commitment.

To meet compliance and regulatory requirements

Everything in Essential

Liveness and Deepfake Verification

Face Match

Electronic Identity Verification (eIDV)

3 KYC questionnaires

Ongoing Document Validity Monitoring

3 Team Members (each additional 10€/month)

PREMIUM

€1.30 /per verification

€499 Minimum monthly commitment.

To protect against any type of risks

Everything in Compliance

High-level Fraud Detection models

Ongoing AML screening

PEPs & Sanctions Screening

Risk Scoring

Unlimited KYC questionnaires

SSO (Google/Azure/OIDC)

Unlimited Team Members

ENTERPRISE

Custom

Offers a custom solution, cloud-based API or On-premise ready to meet any unique business requirement and volume.

Everything we offer

Proof of Address (PoA)

Business Verification (KYB)

Video KYC

Custom SLAs and Priority Support

External Database Validations

Cloud-based API or an on-premises installation

Custom solution capable of handling any number of request