In today’s digital era, secure identity verification is a cornerstone for financial institutions.

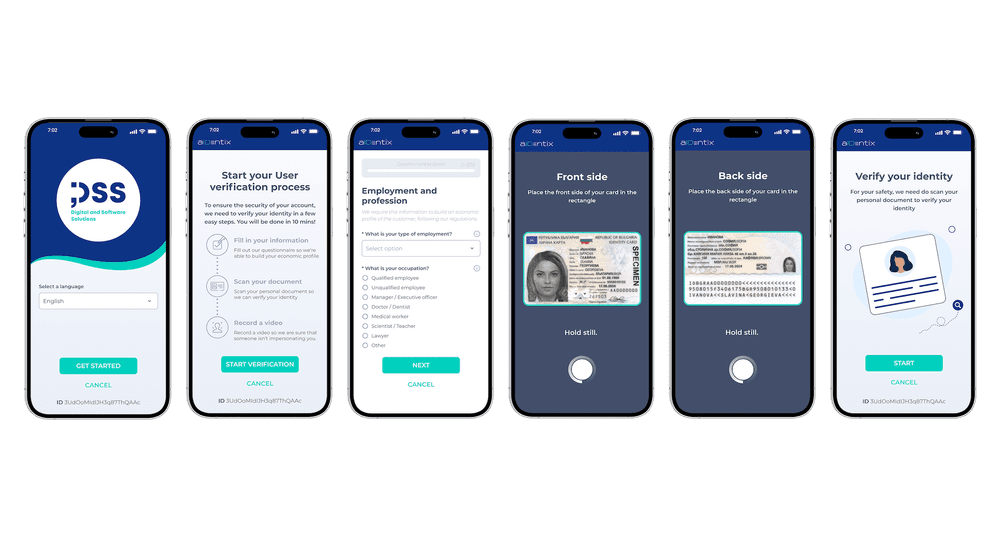

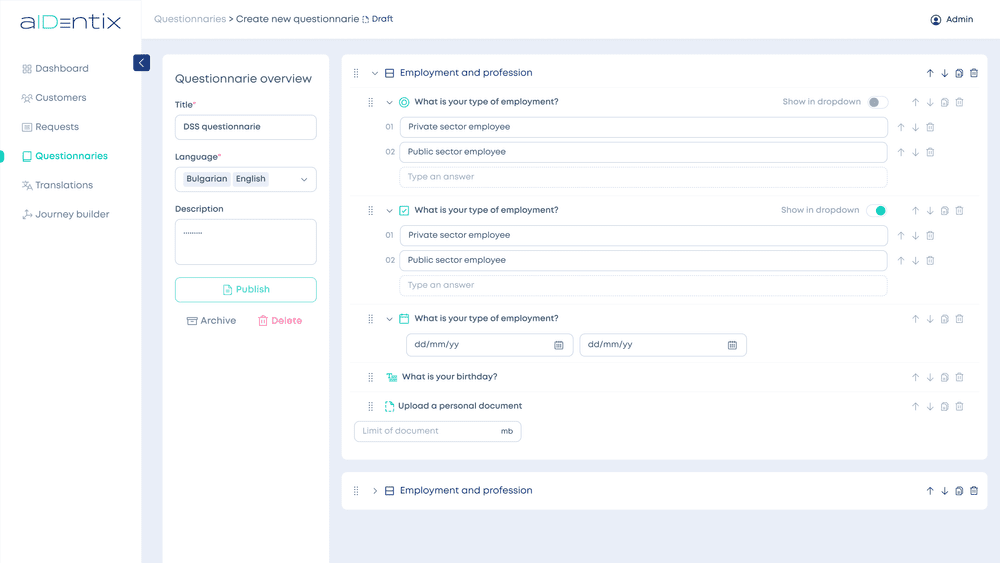

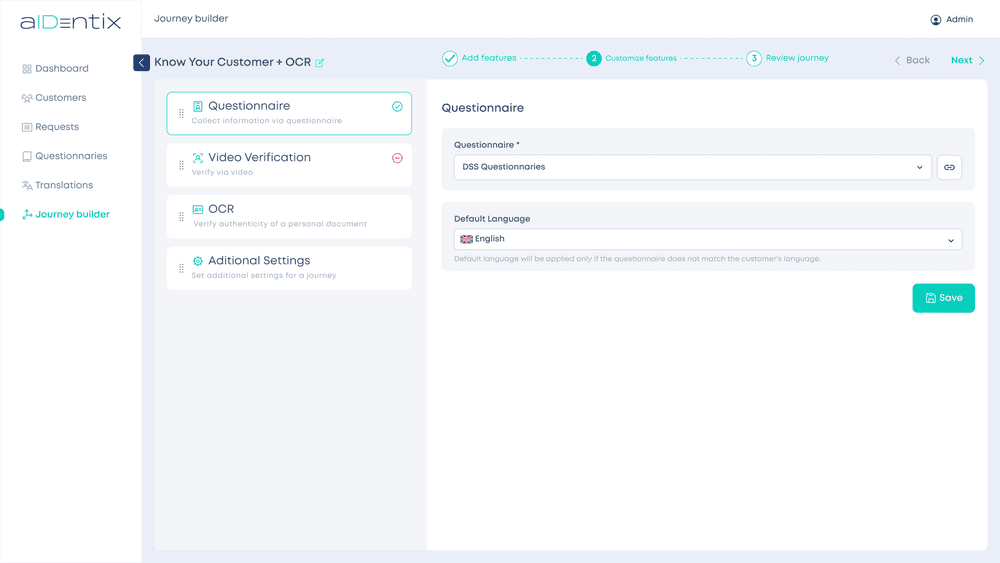

aIDentix simplifies this process by offering an innovative platform for

digital identification and KYC, helping banks and financial institutions enhance security and compliance while improving customer onboarding. aIDentix leverages advanced technologies like

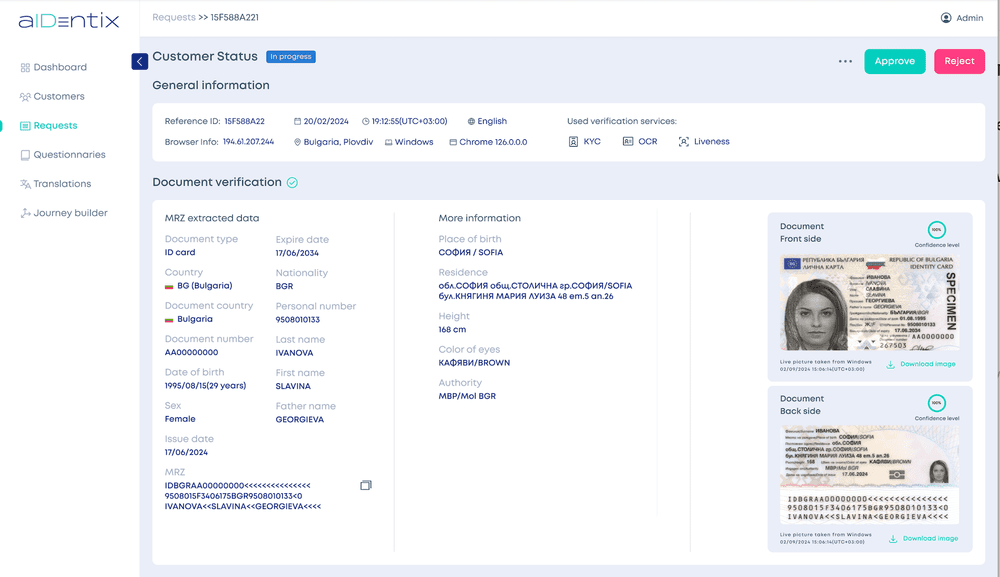

Optical Character Recognition (OCR) for document verification. It also includes liveness verification, using biometrics to prevent identity fraud. The platform is not just about security. It’s also about compliance. aIDentix helps organisations adhere to

Anti-Money Laundering (AML) regulations, a critical aspect of operating in the finance sector. With its

plug and play solution, aIDentix can be easily integrated into existing systems. It even offers a self-hosted option for those who need control over their data. In this article, we’ll explore how aIDentix can help you implement secure digital identification and KYC.

Understanding Digital Identification and KYC

aIDentix is more than just proving who you are. It involves verifying identities securely and efficiently using digital tools. This approach reduces the risk of fraud and speeds up processes for companies. KYC, or Know Your Customer, is an essential part of this. Under 6th Anti-Money Laundering Directive (6AMLD), formally known as

Directive (EU) 2018/1673, banks and financial institutions are required to verify the identity of their clients. This helps prevent money laundering and other illicit activities. Traditional KYC processes are often cumbersome and time-consuming. aIDentix

automates up to 100% of manual tasks, significantly reducing processing time and human effort. With an

accuracy rate (confidence level) exceeding 95% when extracting data from personal documents, the platform ensures precise verification while maintaining full compliance with regulatory standards. This automation not only strengthens security but also enhances the overall customer experience. Advanced technologies provide a robust backbone for digital identification. They facilitate rapid, secure verification and drive compliance, setting a standard for financial services. Overall, aIDentix offers significant benefits in data handling, compliance, and customer satisfaction.

Introducing aIDentix: A Comprehensive Solution

aIDentix provides a powerful solution for secure digital identification tailored to the evolving needs of modern financial institutions. As highlighted in

this article on DSS’s website, the platform offers seamless integration with existing systems through its plug-and-play capabilities, ensuring effortless implementation. With a user-friendly design, aIDentix accommodates organizations of all sizes, enhancing their KYC processes to bolster compliance and streamline customer onboarding. Its advanced features—such as identity verification, fraud prevention, and compliance management—make it a comprehensive tool for tackling the challenges of today’s regulatory environment.