Empowering Fintech with Smarter Identity Verification

95%+

Verification Accuracy

Industry-leading precision in biometric and document-based identity checks.

15 < Seconds

Avg. Verification Time

Fast, seamless onboarding that keeps your conversion rates high.

70%

Faster Customer Onboarding

Slash onboarding time and boost user conversion with real-time verification.

95%+

Verification Accuracy

Industry-leading precision in biometric and document-based identity checks.

15 < Seconds

Avg. Verification Time

Fast, seamless onboarding that keeps your conversion rates high.

70%

Faster Customer Onboarding

Slash onboarding time and boost user conversion with real-time verification.

Navigating Compliance, Fraud, and Customer Experience

Fintechs face mounting regulatory requirements, escalating fraud attempts, and the pressure to deliver fast, frictionless onboarding. Balancing airtight security with a seamless user journey is essential for growth and trust.

Streamlined Compliance

Stronger Fraud Prevention

Frictionless Customer Onboarding

Data Accuracy and Reliability

AI-Driven Verification

High Security Standards

Frictionless User Experience

Regulatory Compliance Ready

Scalable & Flexible

How aIDentix Supports Fintech

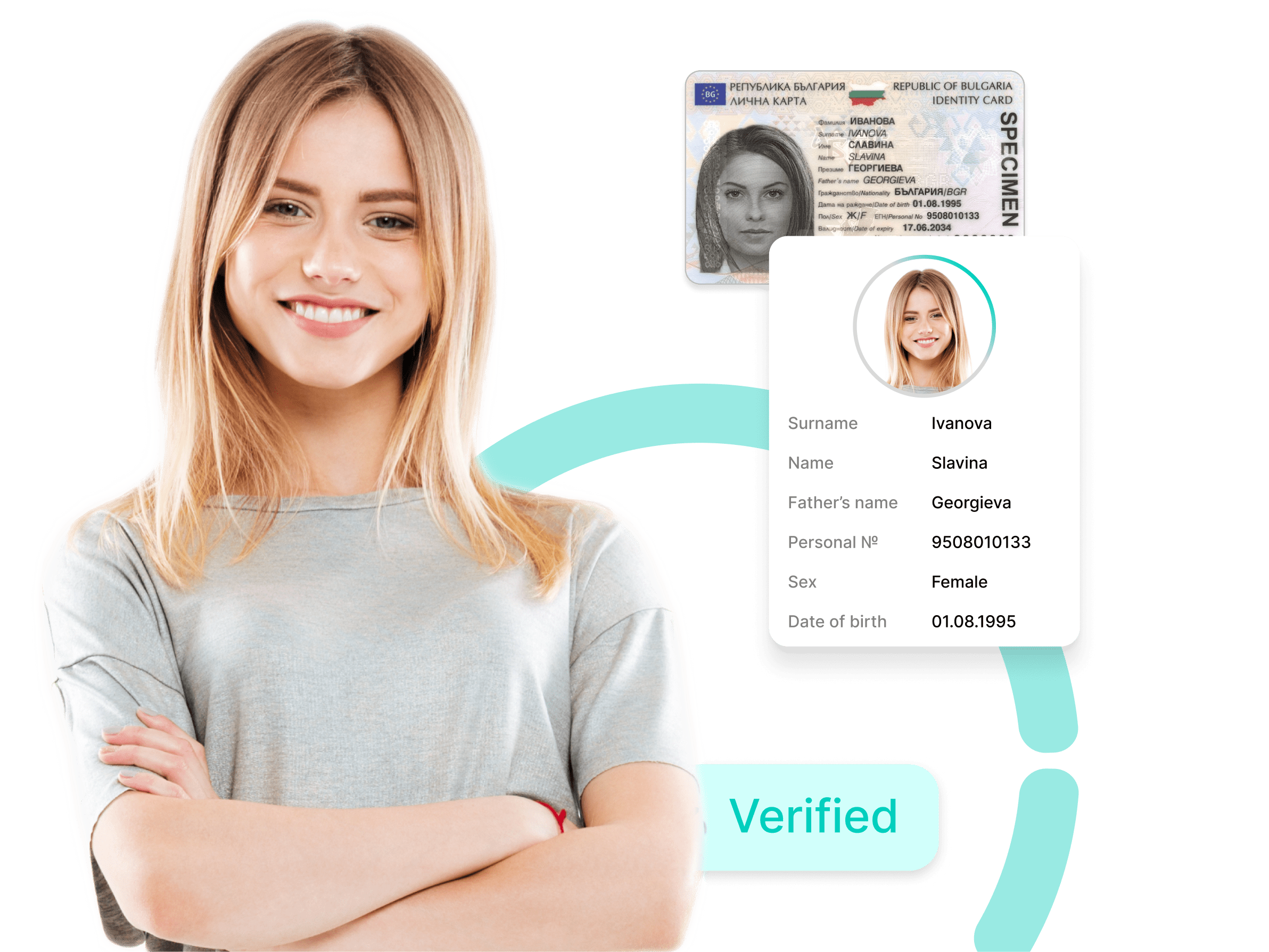

Frictionless Identity in 3 Steps

Why it Matters

for Fintech?

Fintechs lose up to 40% of customers during onboarding due to friction

Our streamlined process reduces drop-off significantly.

Financial institutions face $32B in average annual fraud losses

aIDentix minimizes exposure with proactive checks.

Pricing That Makes Sense

Common Questions, Clear Answers.

Do you need help in understanding what Optical Character Recognition is, how it works, and how you can benefit from identity verification solutions? This is particularly important in order to mitigate fraud and ensure that you are dealing with legitimate customers. We’ve got you covered!

Contact us to see it in action.