Automate Data Extraction. Streamline Workflows.

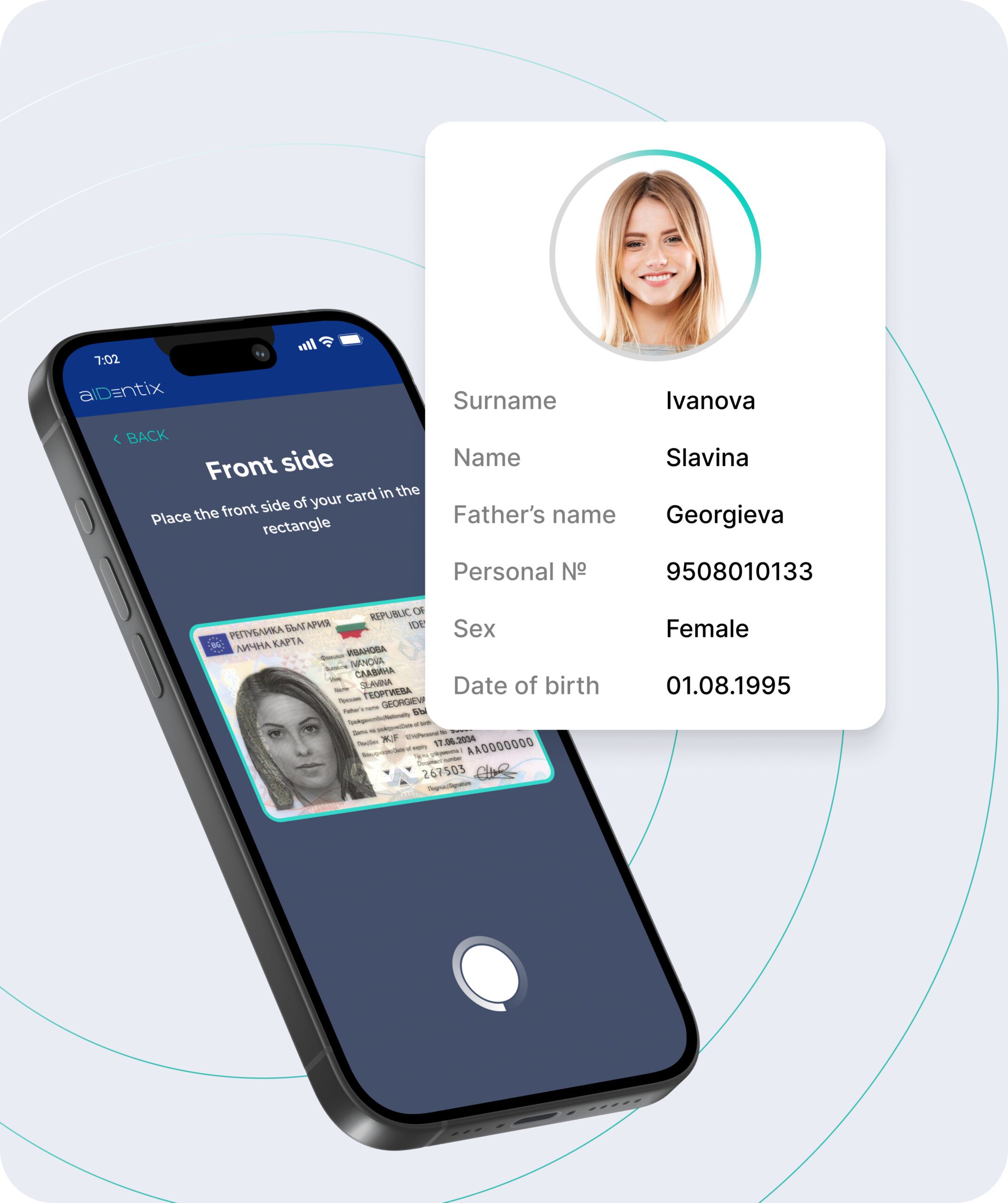

Boost efficiency and accuracy with aIDenix’s powerful Optical Character Recognition (OCR) technology that transforms physical documents into actionable digital data.

8+ customers are satisfied with our service

01 Benefits

Turn documents into data - instantly.

Effortless Data Extraction

Automate the process of extracting data from scanned documents, invoices, and forms. Eliminate manual data entry and reduce the risk of human error.

Increased Productivity

Automate tedious data capture tasks to free up your team’s valuable time. Then, focus on higher-level activities that add strategic value to your core business.

Enhanced Accuracy

Minimize errors, duplicates or inconsistencies with next-generation OCR technology. Ensure data integrity and improve decision-making.

Improved Customer Experience

Streamline workflows and expedite processes for faster customer service and interaction.

Scalability and Flexibility

Integrate OCR seamlessly into existing workflows and handle high volumes of documents with ease.

Multilingual Support

Process documents in various languages, expanding your reach and global capabilities.

200,000+

KYC Answers

8

Happy Customers

1,000,000+

Processed Documents

02 How we help

Digital Identity You Can Trust

aIDentix makes digital identity simple and secure. Our platform combines liveness verification, advanced document checks, and external database validation to deliver reliable results in seconds. Designed for seamless integration, aIDentix helps businesses verify customers quickly, prevent fraud, and build digital trust—without adding complexity.

From Document to Verified.

Verifying an identity should be fast, secure, and seamless. Our OCR-driven process captures and authenticates ID documents in real time—transforming images into verified data in just a few simple steps.

03 How it works

04 Advanced Features

Beyond Basic Verification

Instantly extract key data from identity documents with high accuracy - reducing manual input, speeding up verification, and supporting multiple languages and formats.

01

Customizable Data Extraction

Specify the exact data points you need to extract, allowing for tailored solutions to your needs.

02

Machine Learning for Accuracy

Our OCR engine continuously learns and improves, ensuring high accuracy even with complex documents or challenging layouts.

03

Image Quality Assessment

The system evaluates image quality and can suggest re-scanning if needed to ensure optimal extraction results.

04

Document Type Detection

The system identifies the type of document (ID card, passport, invoice, etc.) for efficient processing.

05 FAQs

Answers You Need: Frequently Asked Questions

Do you have any other questions?

What is digital identity verification?

Digital identity verification is the process of confirming a person’s identity using digital methods, such as scanning documents, checking liveness and physical presence via video, and responding to validation instructions. It helps reduce fraud, ensure compliance, and significantly speeds up the verification process by eliminating the need for users to visit a physical office.

Is your solution compliant with data privacy regulations?

Yes. aIDentix is designed to be compliant with global data protection standards, including GDPR, ISO 9001:2015, ISO/IEC 20000-1:2018, ISO/IEC 27001:2022, ISO/IEC 27701:2019 and other relevant regulations. All user data is encrypted and securely stored.

Who can use this service?

aIDentix can be used by businesses across industries—such as finance, insurance, healthcare, and e-commerce—that need to onboard or verify users securely.

What types of documents can be verified?

aIDentix supports a wide range of government-issued identity documents, including international passports, driver’s licenses, and European Union national ID cards. Our product is designed with scalability in mind, and we are actively working to expand support for additional countries and document types based on our product roadmap and client requirements.

06 Feedback

Hear from our clients

Our partners' success speaks for itself — their glowing feedback is a reflection of the impact we strive to deliver every day.

Unicredit Bulbank partnered with DSS to implement an Optical Character Recognition solution that provides an automated KYC process for the bank's retail users. It is a plug-and-play system that does not require any development effort from our team. It takes a photo of an ID, crops the necessary format, and extracts the relevant information types (name, address, ID number), which is then returned in a machine-readable form. This seamless process is much faster and eliminates the possibility of human errors, resulting in a significantly improved customer experience. We highly recommend DSS's OCR product for easy document digitisation.

Anton Kutev

Strategic Initiatives Manager at Unicredit Bulbank

We recently integrated aIDentix into our mobile onboarding process. The app is extremely user-friendly, making it easy for our customers to complete their identity verification quickly and securely. It has significantly reduced onboarding time while ensuring we remain fully compliant with regulatory standards. The accuracy and reliability of digital identity verification and KYC's customisation capabilities allowed us to seamlessly tailor the process to meet our specific needs. aIDentix has not only improved our operational efficiency but also improved the overall customer experience. We highly recommend it for any financial institution looking to optimize their onboarding process.

Senior Manager

Digital Channels at local Bank

07 FAQs

Answers You Need: Frequently Asked Questions

Do you have any other questions?

What is digital identity verification?

Digital identity verification is the process

of confirming a person’s identity using digital methods, such as scanning

documents, checking liveness and physical presence via video, and responding

to validation instructions. It helps reduce fraud, ensure compliance, and

significantly speeds up the verification process by eliminating the need for users

to visit a physical office.

Is your solution compliant with data privacy regulations?

Yes. aIDentix is

designed to be compliant with global data protection standards, including GDPR,

ISO 9001:2015, ISO/IEC 20000-1:2018, ISO/IEC 27001:2022, ISO/IEC

27701:2019 and other relevant regulations. All user data is encrypted and

securely stored.

Who can use this service?

aIDentix can be used by businesses across

industries—such as finance, insurance, healthcare, and e-commerce—that need

to onboard or verify users securely.

What types of documents can be verified?

aIDentix supports a wide range of

government-issued identity documents, including international passports, driver’s

licenses, and European Union national ID cards. Our product is designed with

scalability in mind, and we are actively working to expand support for additional

countries and document types based on our product roadmap and client

requirements.

aIDentix integrates with your

internal and external data providers

A diversified set of data sources spanning the

financial services industry.

Web SDK

Connected

Mobile SDK

Connected

REST API

Connected

QR code

Connected