Frictionless Onboarding. Streamlined Compliance.

Automate ID verification with aIDentix and reduce manual work while ensuring KYC compliance.

500 000+ verified identities

Your Solution, Your Way

Pick desired features or book a comprehensive aIDentix solution

Customize your toolkit — pick individual features or unlock the full power of aIDentix.

Plug and Play

aIDentix is simple to set up, giving you all the tools to start identity verification

instantly-no coding or development needed.

Modular based

Choose how you use aIDentix: run it as a full 360° solution or activate only the

modules that match your business needs.

Variety of documents

aIDentix verifies IDs, passports, and driving licenses, accurately extracting details

like names, dates, and addresses.

Enhanced KYC process

With fast OCR, customer data is captured in seconds, replacing manual entry and

making KYC smoother and more reliable.

Faster, Smarter Compliance

Simplify Identity Verification with aIDentix: Smart KYC, Face Matching & OCR Automation

Automate KYC with face matching, retention checks, and AI-powered OCR - all in one seamless flow.

1 OCR 2 ID Verification 3 KYC & Custom Questionnaire 4 Liveness Verification 5 Database Verification

Enable remote capture of an ID card or document from all sides and automatically extract the data.

Enable remote capture of an ID card or document from all sides and automatically extract the data.

- Capture ID cards remotely from all sides using any device.

- Extract data automatically with AI-powered OCR and validation.

- Speed up onboarding with secure, contactless identity checks.

Verify users’ IDs, passports and personal documents, automate onboarding procedures and detect fraud using AI-powered algorithms.

Verify users’ IDs, passports and personal documents, automate onboarding procedures and detect fraud using AI-powered algorithms.

- Verify ID cards, passports, and personal documents remotely and securely.

- Automate onboarding with fast, AI-driven identity verification workflows.

- Detect fraud in real time using advanced AI-powered algorithms.

Create custom KYC questionnaires, tailored to your specific needs and regulatory requirements.

Create custom KYC questionnaires, tailored to your specific needs and regulatory requirements.

- Create custom KYC questionnaires that match your business needs.

- Ensure compliance with local and global regulatory requirements.

- Easily adapt identity verification flows to your industry and risk level.

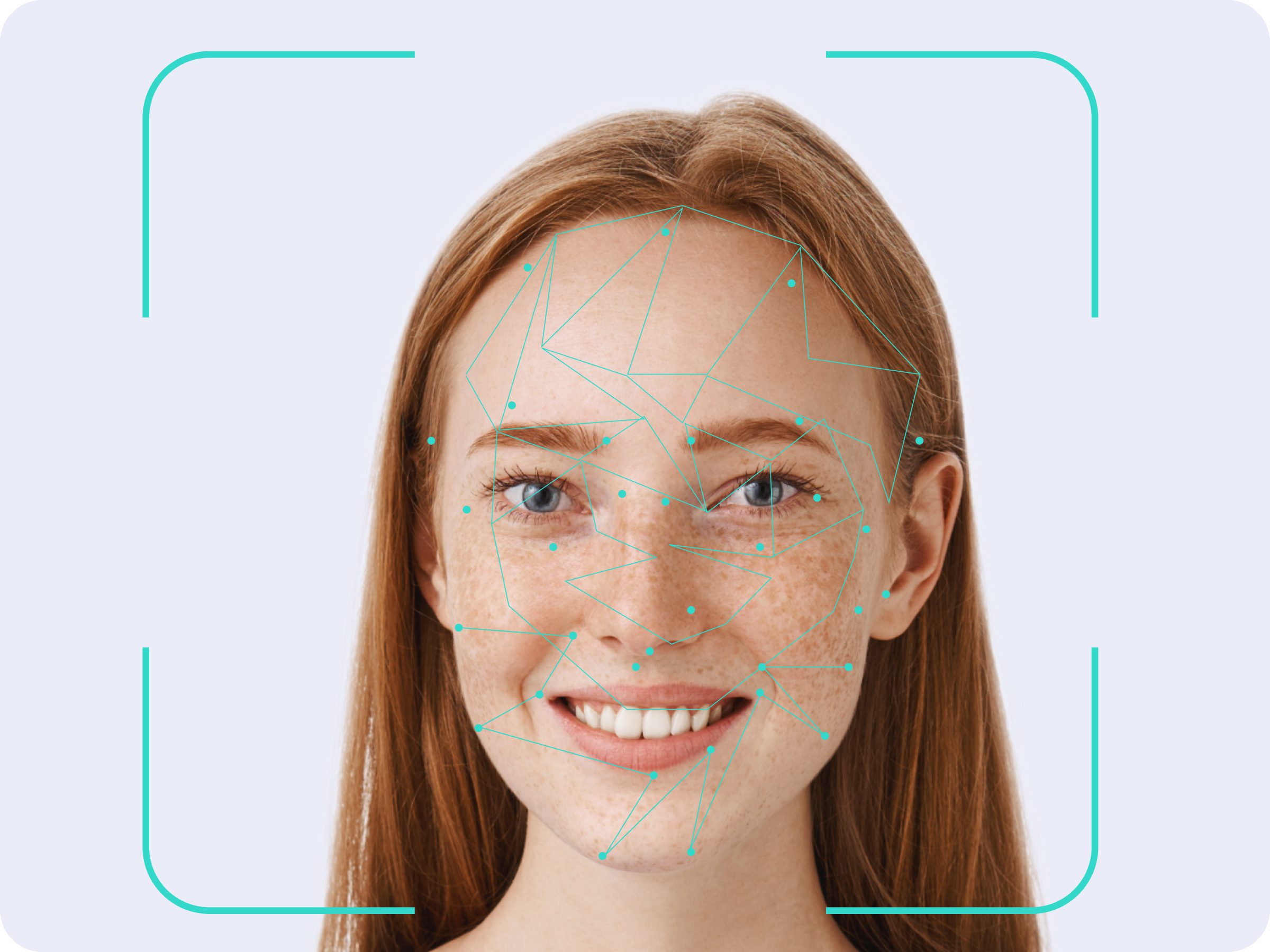

Confirm the identity of the document holder by verifying their liveness and face match through human gestures and facial expressions check.

Confirm the identity of the document holder by verifying their liveness and face match through human gestures and facial expressions check.

- Confirm user identity with real-time face match and liveness detection.

- Use gesture and expression checks to prevent spoofing and deepfakes.

- Enhance security with AI-driven biometric verification.

As an additional measure to prevent fraud, conduct thorough checks on public databases, population registers, and PEPS lists, etc.

As an additional measure to prevent fraud, conduct thorough checks on public databases, population registers, and PEPS lists, etc.

- Strengthen identity checks with access to public databases and registers.

- Screen users against PEPS, sanctions, and watchlists for added security.

- Prevent fraud with deep background verification and risk assessment tools.

Transparent Pricing

Pricing That Makes Sense

ESSENTIAL

€0.30 /per verification

€99 Minimum monthly commitment.

To cover essential business needs like client’s identity verification.

Document Verification

Age Verification

1 KYC questionnaires

Email Verification

Multi-factor Authentication

1 Team Member (each additional 10€/month)

COMPLIANCE

Best Plan

€0.70 /per verification

€199 Minimum monthly commitment.

To meet compliance and regulatory requirements

Everything in Essential

Liveness and Deepfake Verification

Face Match

Electronic Identity Verification (eIDV)

3 KYC questionnaires

Ongoing Document Validity Monitoring

3 Team Members (each additional 10€/month)

PREMIUM

€1.30 /per verification

€499 Minimum monthly commitment.

To protect against any type of risks

Everything in Compliance

High-level Fraud Detection models

Ongoing AML Screening

PEPs & Sanctions Screening

Risk Scoring

Unlimited KYC questionnaires

SSO (Google/Azure/OIDC)

Unlimited Team Members

ENTERPRISE

Custom

Offers a custom solution, cloud-based API or On-premise ready to meet any unique business requirement and volume.

Everything we offer

Proof of Address (PoA)

Business Verification (KYB)

Video KYC

Custom SLAs and Priority Support

External Database Validations

Cloud-based API or an on-premises installation

Custom solution capable of handling any number of request

Plug & Play Verification

Effortless Integrations

aIDentix Integration Options: Web SDK, Mobile SDK, REST API & QR Authentication

Web SDK

Easily add biometric login and identity verification to your website using the aIDentix Web SDK—enhancing security and user experience with real-time face recognition.

Mobile SDK

The aIDentix Mobile SDK empowers your app with advanced biometric authentication, helping reduce fraud, streamline user onboarding, and build trust through secure, touchless identity verification.

REST API

Integrate biometric verification into your workflow with the aIDentix REST API—reducing fraud risk and accelerating identity validation without disrupting your existing infrastructure.

QR code

Integrate aIDentix QR-based biometric login to offer fast, secure, and user-friendly authentication across devices—perfect for financial services, customer portals, and enterprise platforms.

Validated by Experience

A journey of innovation and success

80+ Supported Documents

1M+

Processed Documents

Processed Documents

8 Happy

Clients

Clients

200K+

KYC Answers

KYC Answers

Your Questions Answered

Common Questions, Clear Answers.

Do you need help in understanding what Optical Character Recognition is, how it works, and how you can benefit from identity verification solutions? This is particularly important in order to mitigate fraud and ensure that you are dealing with legitimate customers. We’ve got you covered!

What is digital identity verification?

Digital identity verification is the process

of confirming a person’s identity using digital methods, such as scanning

documents, checking liveness and physical presence via video, and responding

to validation instructions. It helps reduce fraud, ensure compliance, and

significantly speeds up the verification process by eliminating the need for users

to visit a physical office.

Is your solution compliant with data privacy regulations?

Yes. aIDentix is

designed to be compliant with global data protection standards, including GDPR,

ISO 9001:2015, ISO/IEC 20000-1:2018, ISO/IEC 27001:2022, ISO/IEC

27701:2019 and other relevant regulations. All user data is encrypted and

securely stored.

Who can use this service?

aIDentix can be used by businesses across

industries—such as finance, insurance, healthcare, and e-commerce—that need

to onboard or verify users securely.

What types of documents can be verified?

aIDentix supports a wide range of

government-issued identity documents, including international passports, driver’s

licenses, and European Union national ID cards. Our product is designed with

scalability in mind, and we are actively working to expand support for additional

countries and document types based on our product roadmap and client

requirements.